Wealthsimple

One of the fastest growing financial firms in Canada offering amazing service and best of all...commission‑free trading on stocks and ETFs like XEQT. Scroll down for more!

Current 3% Match Promo

One of the fastest growing financial firms in Canada offering amazing service and best of all...commission‑free trading on stocks and ETFs like XEQT. Scroll down for more!

Current 3% Match Promo

| Trading Platform | Wealthsimple |

|---|---|

| Year Founded | 2014 |

| Accounts Offered | TFSA, RRSP, FHSA, Chequing, Savings, USD, CAD, Corporate, Crypto |

| Fees | None |

| Star Rating | 5/5 |

| Current Sign Up Offer | Get up to a 3% match. Win a $3M home. (Terms Apply - See WS site) |

If you’re a long‑term investor, the kind who buys consistently, ignores the noise, and lets compounding do its thing then Wealthsimple is honestly one of the most powerful platforms available in Canada right now.

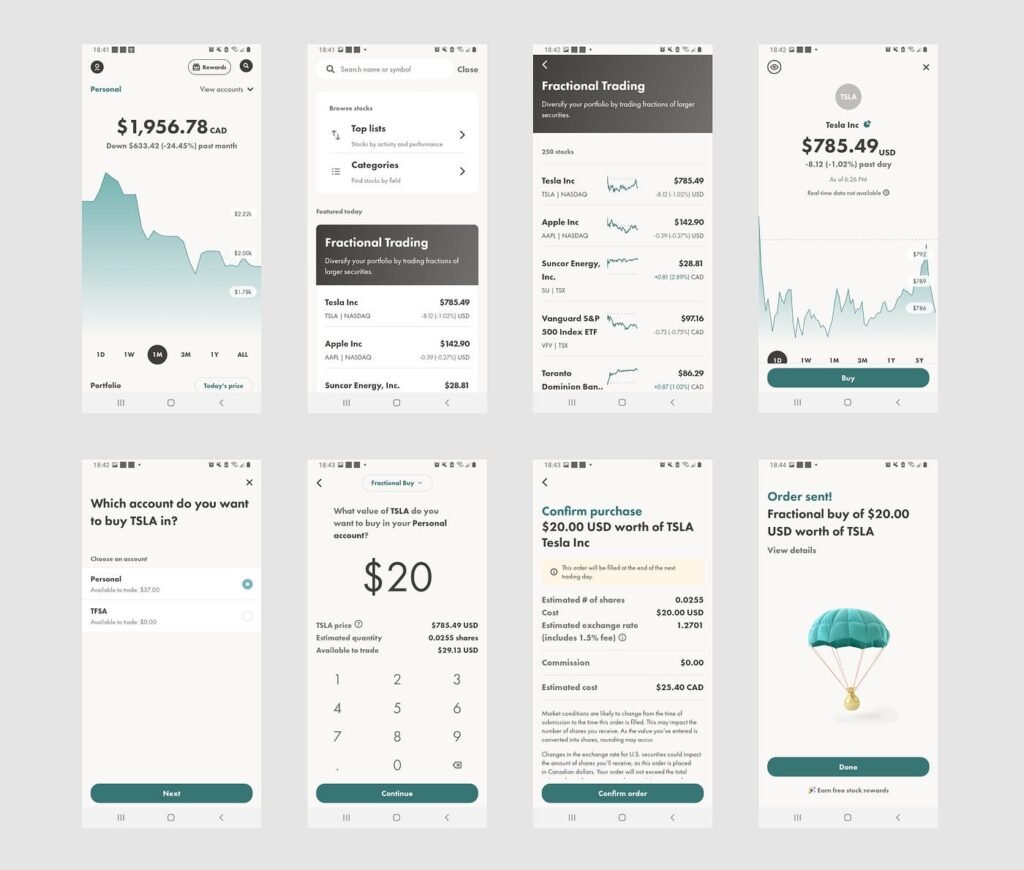

What makes it stand out isn’t flashy trading tools or day‑trader bells and whistles… it’s the simplicity, the cost structure, and how frictionless it makes long‑term wealth building.

The headline feature and the one that matters the most is commission‑free trading on stocks and ETFs like XEQT.

That sounds basic… until you zoom out.

When you’re making consistent buys whether it be weekly, bi‑weekly, or monthly, the commissions quietly eat into your returns over time. Traditional brokerages charging $5–$10 per trade don’t seem expensive… until you’re placing 100+ trades a year.

Wealthsimple removes that drag entirely.

That means:

You can dollar‑cost average without thinking about fees

Small contributions actually make sense

Reinvesting dividends doesn’t feel punitive

Building positions over time is frictionless

For long‑term ETF investors especially, this is massive. The ability to automate deposits and deploy capital regularly without worrying about trade costs is a compounding advantage most investors underestimate.

Wealthsimple has evolved from “just a robo‑advisor” into a full financial ecosystem. You can run almost your entire financial life through it now. Some, like the guys behind the site dumped their CIBC and RBC accounts completely and solely use Wealthsimple for their day to day banking.

Here’s the lineup:

Registered Investing Accounts

TFSA

RRSP

FHSA

RESP (managed side)

Non‑Registered & Specialty

Personal (cash / margin where eligible)

Corporate accounts

Banking & Cash

Chequing (Wealthsimple Cash)

High‑interest Savings

USD Savings

Alternative

Crypto Accounts

The big win here is consolidation. You can invest, save, hold USD, and manage tax‑advantaged accounts all under one roof without juggling multiple institutions.

And unlike traditional banks, many of these accounts come with no monthly fees and no minimum balances.

This is where Wealthsimple really separates itself from legacy banks.

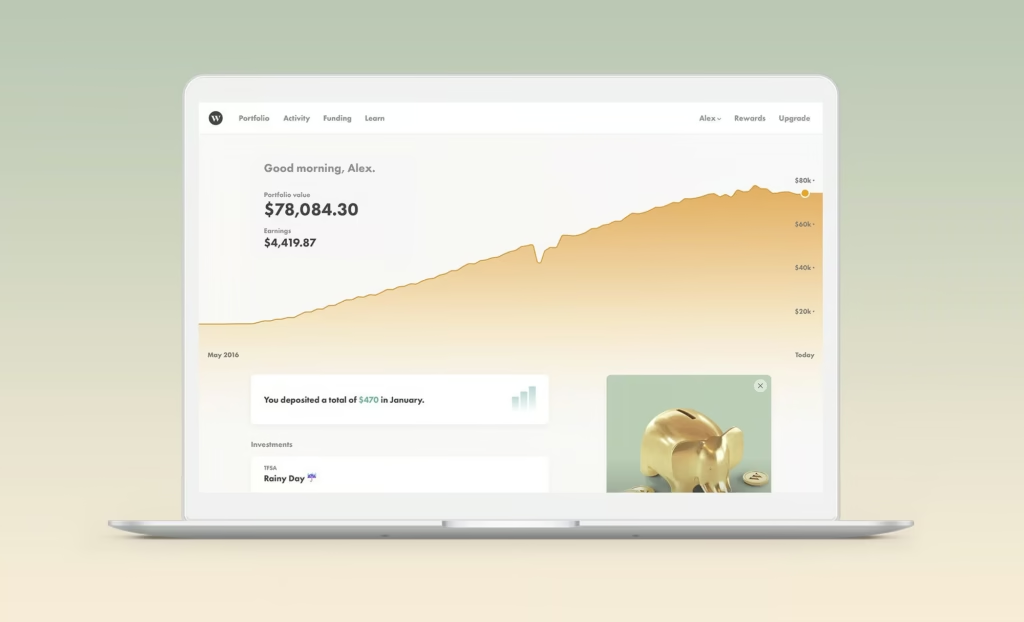

The mobile app and web platform are:

Clean and well laid out

Fast

Beginner‑friendly

Visually modern

Everything from onboarding → funding → buying → tracking performance feels seamless.

Even seasoned investors appreciate how intuitive it is. Reviews consistently highlight the platform’s ease of use and clean design compared to “clunky” bank brokerages.

You’re not digging through 12 tabs to find a holding. You open the app and everything just makes sense.

For investors who check portfolios regularly, that UX difference matters more than people think.

Customer support is one area where fintechs often struggle but Wealthsimple generally reviews well here (with some mixed experiences, as with any large platform).

Support options include:

Live chat (though only during EST business hours)

Phone

Virtual assistant 24/7

Many users highlight helpful reps and smooth issue resolution.

From community feedback:

“Personable, not rushing and very helpful.”

Others mention reps following up proactively or resolving fraud and account issues thoroughly, the kind of human touch you don’t always expect from a digital‑first platform.

Like any financial institution, there are occasional complaints around wait times or transfers but overall sentiment trends positive, especially among long‑term investors rather than active traders.

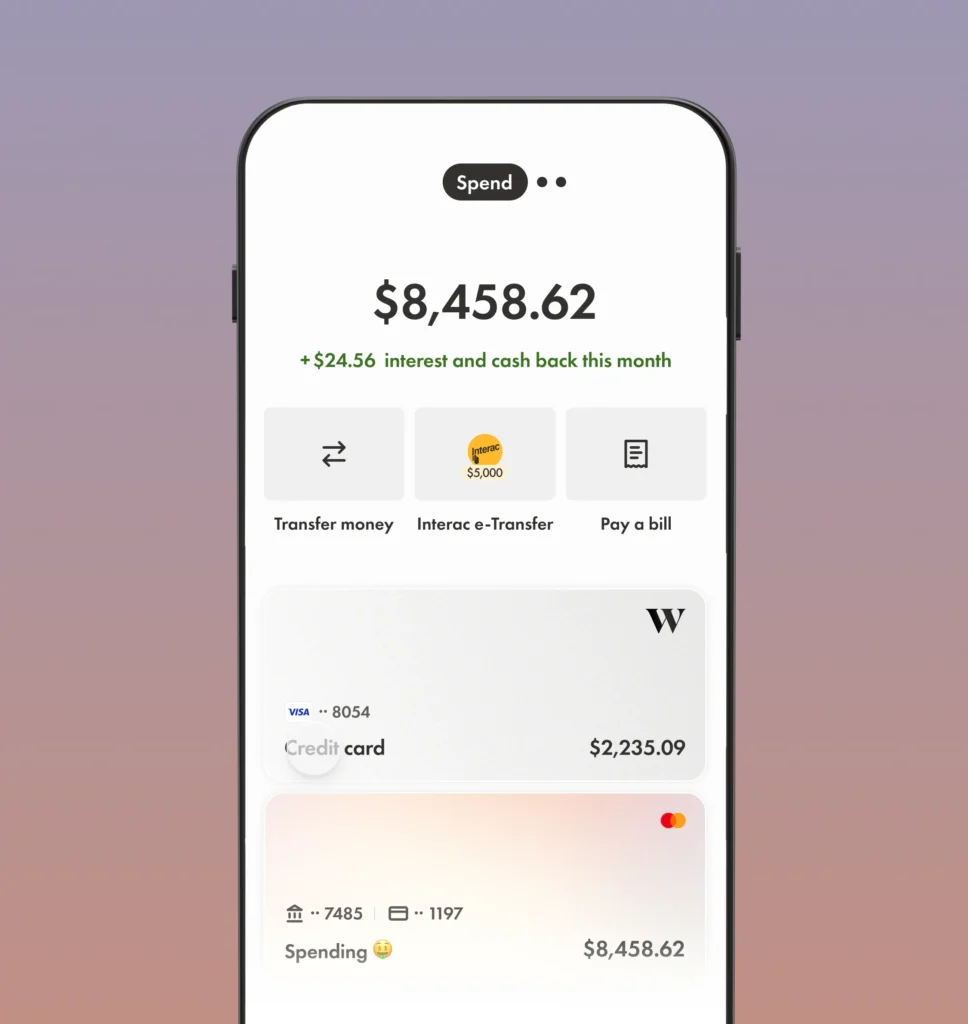

Wealthsimple isn’t just for investing anymore.

Its cash and savings products add real everyday utility:

Interest‑earning chequing balances

No monthly account fees

No ATM fees (with reimbursements)

High‑interest USD savings options

This turns the platform into more of a financial hub and not just a brokerage.

You can get paid, save, invest, and deploy capital without moving money across institutions constantly.

No platform is flawless.

Common critiques you’ll see:

FX fees on U.S. trades unless using USD accounts / subscriptions

Limited advanced trading tools

Not ideal for day traders

Some deposit or withdrawal delays (more related to holds and clearing)

But for the audience it’s built for, the long‑term, passive, consistency‑focused investors, these are minor trade‑offs.

Wealthsimple shines brightest when used the way wealth is actually built:

Slowly. Consistently. Over time.

Why long‑term investors love it:

$0 commission trades (huge for DCA)

Seamless recurring investing

Full suite of registered accounts

Integrated banking & savings

Clean, modern interface

Strong overall support experience

If your strategy is:

Buy great ETFs or stocks → contribute regularly → hold for years

…then Wealthsimple isn’t just convenient, it’s structurally advantageous.

Free trades remove friction. Automation builds discipline. And the platform design keeps you engaged without overwhelming you.